The medical teams working around the world to combat what is becoming a very long global pandemic are to be commended for their continued dedication to saving lives. But medical staff can only do their jobs because medical device manufacturers are managing to produce equipment and push it through the logistics pipeline.

Changing production amidst crisis

Many manufacturing companies raced to respond to the “Black Swan” COVID-19 outbreak. The list of teams coming together was astounding, from producing masks (like Sharp who adapted their LCD clean-room production facilities) to hand sanitizers (such as Tito who pivoted from vodka production).

Another example is CasArc, a division of Colfax focused on gas control equipment. By May of 2020, they had supplied 8000 medical oxygen regulators to overwhelmed and temporary hospitals as well as found an innovative solution for blending air and oxygen for hospital ventilators.

This is not intended to underplay the advanced technology and high precision that goes into manufacturing medical instruments and devices, an industry where innovation is paramount and state-of-the-art engineering design adds value.

This is not intended to underplay the advanced technology and high precision that goes into manufacturing medical instruments and devices, an industry where innovation is paramount and state-of-the-art engineering design adds value.

But in order for production to happen, the supply chain must function.

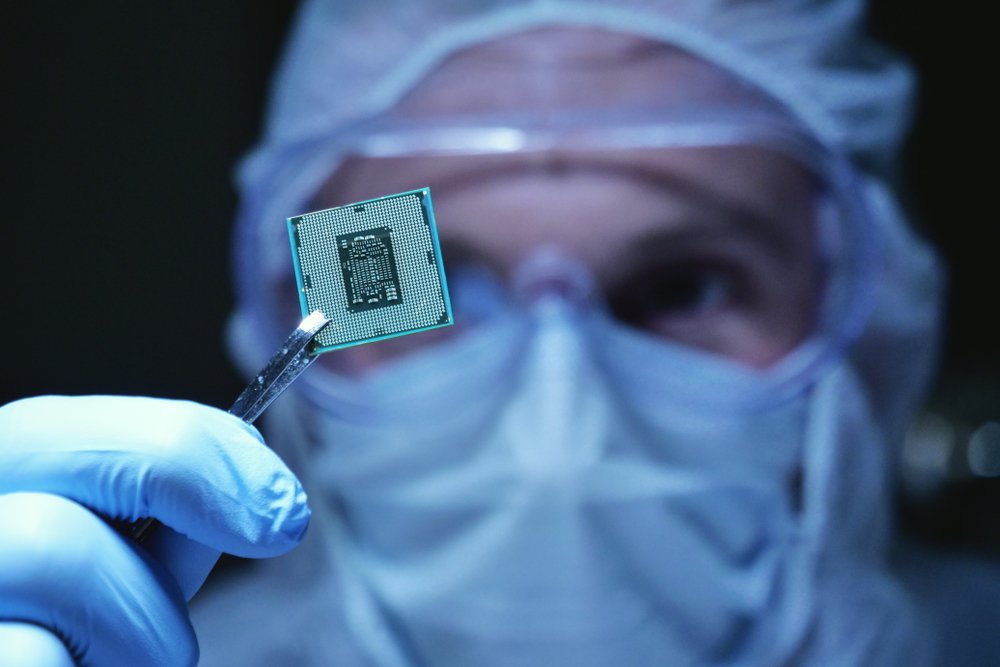

Let’s talk chips

Medical device manufacturers spent an estimated $6.4 billion on computer chips in 2021, according to Gartner. However, this is relatively small compared to the automotive industry ($49 billion) and wireless devices ($170 billion).

We have seen firsthand the wait time for chips go from 14 days to over 52 weeks for some of our clients fueled by the pandemic changes, especially the demand for electronics, and a perfect storm raging against world production.

Some industries are hit harder than others, and new vehicle buyers are bemoaning up a storm. But for patients needing ICU devices, MRIs, pacemakers, and blood-sugar monitors, this becomes a matter of life and death rather than convivence.

“Hospitals are also experiencing long order delays because of the semiconductor shortage,” Mike Schiller, senior director for supply chains at the AHRMM, explained to the Wall Street Journal. “Some members have reported monthslong delays for new CT scanners, defibrillators and telemetry monitors, machines that track patients’ vital signs.”

A recent Deloitte survey of medical technology companies cites delays, cutbacks and cancellations as top issues during the supply chain crisis.

David and Goliath

Industry experts depict a David and Goliath picture of medical companies competing with bigger companies with more clout.

“Everyone else is faced with the same struggle,” Willy C. Shih, an international trade expert at Harvard Business School, tells The New York Times. “But it is true that if you are Apple or someone who buys a lot, you probably get more attention.”

ResMed’s chief executive Michael Farrell expands. “Medical devices are getting starved here. Do we need one more cellphone? One more electric car? One more cloud-connected refrigerator? Or do we need one more ventilator that gives the gift of breath to somebody?” For ResMed, the chip shortage has constrained production so severely that they can only make 75 percent of what their customers need. Farrell's struggle is a common one these days, filled with beseeching his suppliers for allocation.

Where the complicated supply chain comes in

Supply chains are a complicated Hydra, not the simple interlinking chain you may envision. Let’s continue Farrell’s particular story to shed light on just a fraction of this complexity.

Faced with a lack of supply of chips from ResMed’s existing supply chain, Farrell looked deeper, investigating the suppliers of his suppliers in the hopes of persuading them to prioritize ResMed’s medical factories.

To cut a long story short, he found that a manufacturer of silicon wafers out of Taiwan had run out of inventory, impacting the next link and restricting the production of the company that combined wafers with circuitry. Moving down the chain, supply tightened for the company that packages those components into clusters. Now on to ResMed’s supplier of circuit boards, who could not buy enough clusters. This left the medical factories in Singapore, Sydney and Atlanta short.

Phew. And that is only one tiny glimpse of what’s going on in the chip supply chain right now.

When a chip saves lives

Medical device makers say their most effective tactic to get priority over larger buyers has been to raise awareness with executives at chip suppliers.

Maybe playing the “our product saves lives” card has paid off.

According to Ed Hisscock, SVP of supply chain management at Trinity Health which operates 90 hospitals across 22 states, his team has been on “high alert” for shortages of thousands of items containing semiconductors for the past six months. But none have yet materialized.

Why should chip manufacturers (blood) bank on the medical device industry?

Medical device manufacturers are ideal customers for chip suppliers. Regardless of the market, the demand for medical devices holds stable, making them resilient even during recessions.

When the market flips towards unprecedented growth in other sectors, the heavy regulation associated with medical products means they aren’t updated as frequently as, say, consumer electronics. This same governance and regulatory clearance make it impossible to quickly switch to new suppliers, as approvals take time, and thus these partnerships experience stability.

Beyond reliable business, medical device makers also typically pay a little more than companies in other sectors because of the quality they require.

How to stack the chips in your favor

Taking specific actions can help mitigate the current supply chain issues, as disruption increases total healthcare supply chain costs, which already average 37.3% of total patient care.

- Extend supply chain visibility. Look beyond the supplier to the silicon level to project supply constraints and bottlenecks. Hopefully, in the not-too-distant future, we'll be able to project when the crisis situation improves.

- Diversify supplier base. Finding new sources reduces risk, and forming new partnerships with distributors, resellers and traders help secure small volumes for urgent components.

- Consider local suppliers. Especially when shipping from the other side of the country or world becomes difficult, look closer to home. Federal or local aid may be available, such as The Greater Cleveland COVID-19 Rapid Response Fund, an example of a public rapid-repose fund.

- Ensure flexible billing systems. Use an invoicing and payment system that allows procurement managers more control over billing and payments, including modifying billing periods and contracting with alternative suppliers.

- Build in resilience. Use BI and external intelligence, combined with improved data analytics, to make your process more robust.

- Hold disaster-preparation drills that test supply availability. The Harvard Business Review touts that running drills incorporating current and alternative suppliers help mitigate large-scale disruptions.

- Fund additional capacity. Sometimes capacity takes time no matter what, but often dedicating financial resources, including more expensive suppliers and materials or additional personnel, can speed up production. Often this means banding together – think Operation Warp Speed for medical device manufacturing.

- Manage your logistics well. Even the best-laid plans disintegrate and production grinds to a halt if available materials and components arrive damaged, late or not at all. Maybe they’re stuck in one of the infamous container ships off the port of LA, or perhaps still in rail transit. An integrated logistics partner can provide visibility while securing capacity with compliant carriers at negotiated rates.

Through the upheaval of the past two years, every industry has experienced unprecedented ups and downs, but none more than the medical industry. But in this volatility, we have seen individuals, companies and government step up efforts and work together. Amidst the suffering, this unity has been heartwarming. As the volatile market situation continues and medical device manufacturers face new challenges, working with a logistics partner to handle the supply chain can reinstate control and stability into the business.