LTL and TL Monthly Market Update

The latest on diesel prices, spot rates, truck tonnage index, carrier news and other critical events from coast to coast.

Published 7/10/2024

LTL AND TL MONTHLY MARKET UPDATE

July 2024

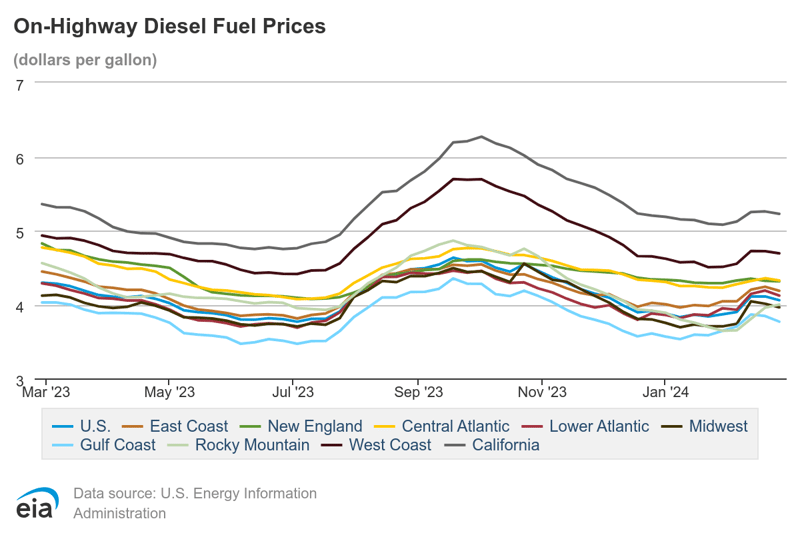

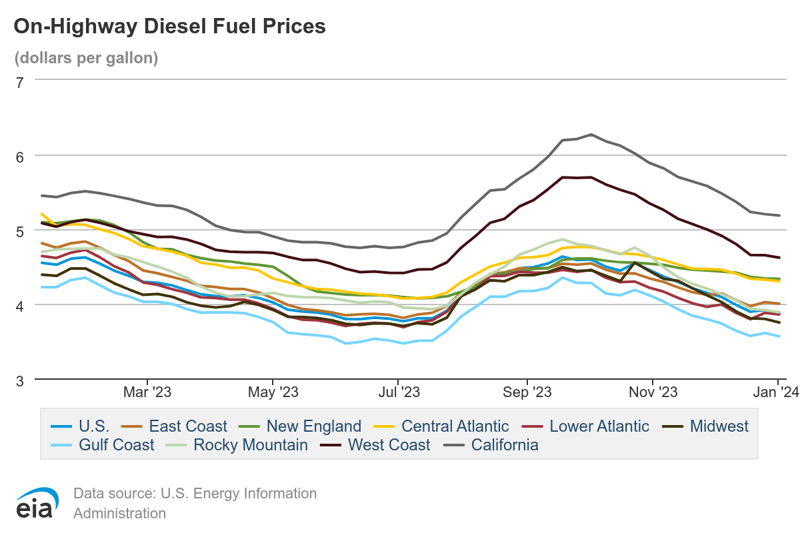

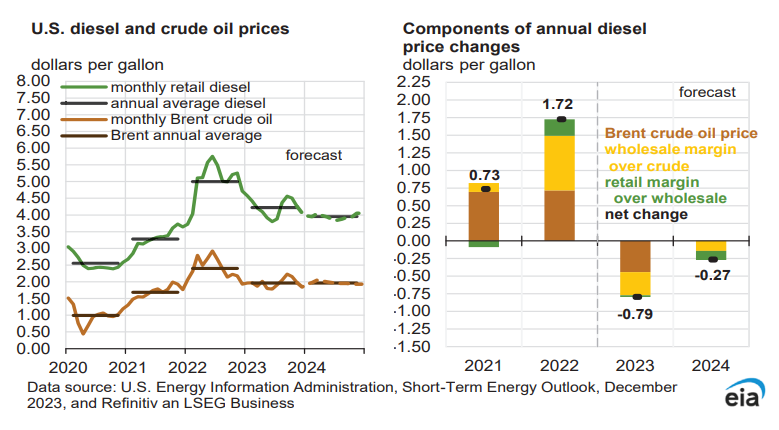

Diesel prices gain slightly throughout June relative to May

The national average diesel prices held relatively steady in June. Diesel prices finished the last full week of the month at $3.769/gal, compared to $3.758 /gal at the end of the prior month. This was up $0.034 from the prior week and down $0.032 relative to the preceding year. The EIA has reduced its 2024 projections by another $0.11.

.png?width=800&height=533&name=On-Highway%20Diesel%20Fuel%20Prices%20(18).png)

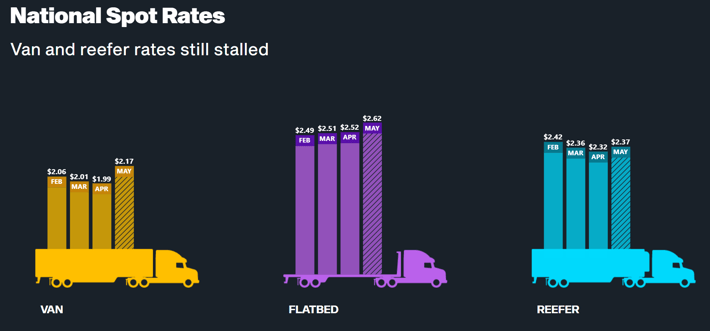

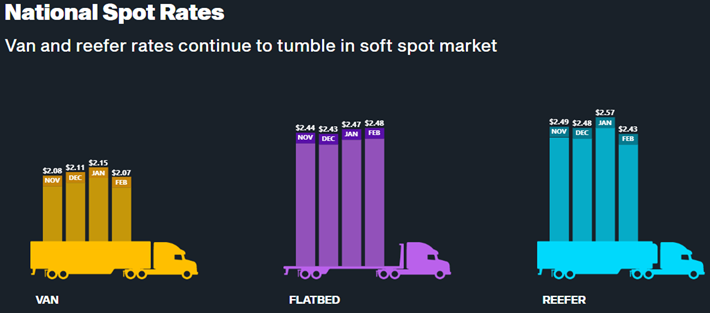

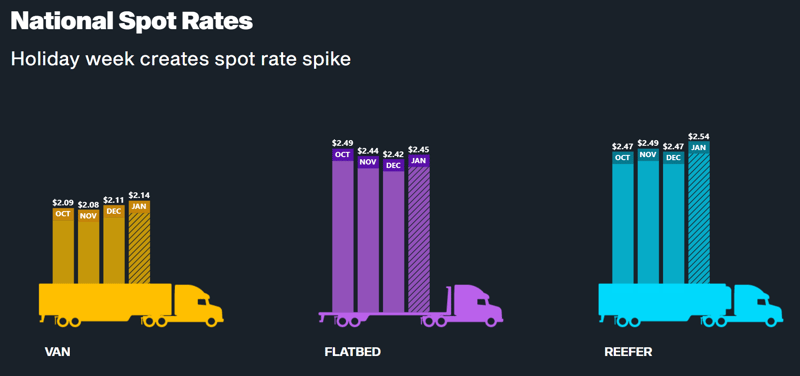

Holiday spot rates show marginal increase

Van and reefer spot rates increased very modestly for the Fourth of July Holiday buildup. Despite the marginal increase in rates, they remain historically low. Historically, the usual holiday buildup drives rates up much more significantly than we've seen this year or last.

Source: DAT

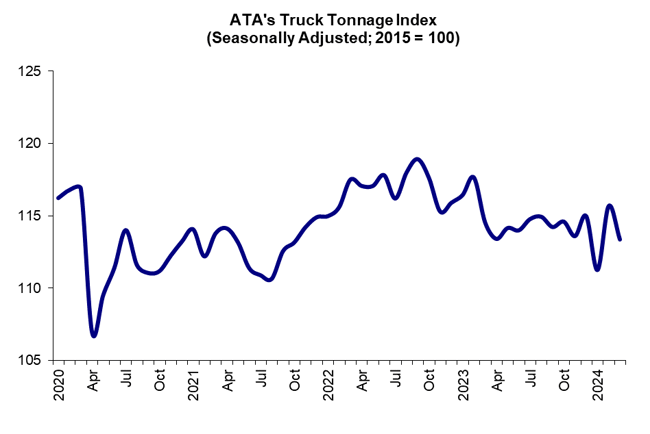

Truck Tonnage Index jumped 3.6% in May

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased by 3.6% in May after decreasing by 1% in April. The index is up 1.5% from May 2023, the first year-over-year gain in fifteen months. While the year-over-year tonnage increase has shifted the momentum, it’s still too early to tell if it’s truly an indicator of a freight recovery.

Source: ATA

News from around the industry

Shuttered California LTL carrier files for bankruptcy

Tony's Express, based in Fontana, CA, has filed for bankruptcy protection. The company abruptly ceased operations three months ago, informing their employees via text message that they no longer had jobs. Tony’s Express President and sole shareholder, John Ohle, is planning to rekindle operations as a truck trailer rental business. (Source: FreightWaves)

FedEx explores options for freight division

FedEx is exploring options to divest from its freight division to focus on its logistics and parcel divisions. As the largest LTL carrier in the market, any shakeup would ripple through the LTL industry, which is still recovering from the Yellow collapse about a year ago. (Source: TruckingDive)

Hurricane Beryl shutters Texas coastal shipping lanes

Houston, Corpus Christi, Galveston, Freeport, and Texas City have all halted their port operations as Hurricane Beryle made landfall in Southeast Texas early Monday morning. Texas ports primarily handle liquid chemicals, steel, and automotive goods. (Source: FreightWaves)

The Market Outlook

At first glance, truckload rates appear to be on the precipice of increasing after a year-long recession in both tonnage and spot rates. We’re just starting to see the first indicators of the tide potentially turning, but we will need another month or two of data to determine if it’s a true market shift or a holiday blip.

As always, you can contact your IL2000 Client Services team if you have any questions.

Sources: EIA, DAT, ATA, FreightWaves, Trucking Dive

Past Market Reports

Published 6/7/2024

LTL AND TL MONTHLY MARKET UPDATE

June 2024

Diesel prices decline throughout May

National average diesel prices dipped in May after some relative stability in Q1. Diesel prices finished the last full week of the month at $3.758/gal compared to $3.947 /gal at the end of the previous month. This marks a weekly drop of $0.031 and a year-over-year decrease of $0.097. The EIA has adjusted its 2024 diesel price projections downward by $0.06.

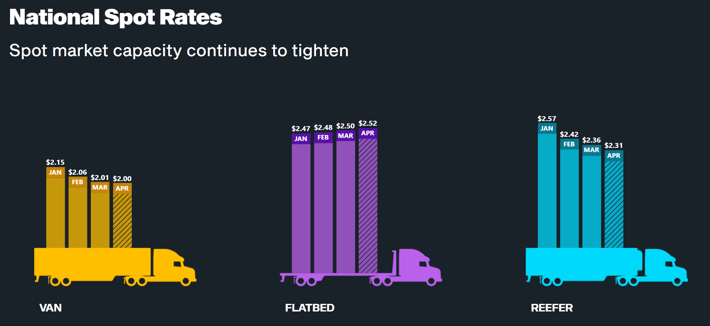

May spot rates remain low

May spot rates for van and flatbed assets showed no upward movement. Reefer rates slightly increased with the start of produce season, though they remain well below historical averages. Typically, Memorial Day brings a spike in van rates as Americans gear up for the long weekend, but there was minimal change this year. Excess capacity and cautious spending by inflation-sensitive consumers contributed to this stability.

Source: DAT

Truck Tonnage Index down 1.2% in April

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index fell by 1.2% in April, following a 2% drop in March. Compared to April 2023, the index is down 1.5%, indicating that the freight recession persists after fourteen consecutive months of year-over-year decline.

Source: ATA

News from around the industry

LTL rates make gains and TL stalls

LTL rate hikes have surged into double digits for several carriers, with overall LTL pricing up 8.2% year over year. Meanwhile, truckload rates have remained at historically low levels, leading to a convergence in pricing between the two modes. As a result, many shippers with substantial LTL freight are transitioning to partial and multi-stop truckloads. (Source: TruckingDive)

Canadian border agent strike looms as unions seek better pay, benefits

Approximately 9,000 border agents at the CBSA (Canada Border Services Agency) are poised to strike on Thursday if an agreement cannot be struck. Mediation sessions between the union and federal officials will begin on Monday. The union is seeking higher wages, more flexibility, and great protections for union members. (Source: FreightWaves)

Moody’s, Fitch downgrade forward air debt; stock decline now above 90%

Last week, Moody’s downgraded the debt of ClueOpCo, a wholly owned subsidiary of Forward Air from B2 to Ba3. ClueOpCo was created following the rocky acquisition of Omni Logistics. Moody’s also downgraded Forward Air’s senior secured first lien term loan from B2 to Ba3. On July 27, 2023, Forward Air’s stock was trading at $121.38. Recently, it hit a 52-week low of $11.21 per share and is currently at $19.35 per share. (Source: Yahoo Finance)

The Market Outlook

LTL capacity continues to tighten, with carriers implementing rate increases that are double or even triple historical trends. Alongside these rate hikes, several carriers are raising the thresholds for negotiating customer-specific pricing. For instance, XPO will only consider new business opportunities if they guarantee at least $500,000 annually. Existing accounts must generate $120,000 annually, or they will be shifted to blanket rates with significantly less favorable terms. While XPO is the most extreme example, other carriers are also becoming stricter in their pricing thresholds.

Meanwhile, the truckload market is experiencing overcapacity, resulting in persistently low rates even during peak season. This has led to a shift where larger, heavier LTL shipments are now more cost-effective to ship via full, partial, or multi-stop truckload. Consequently, LTL carriers report declining average shipment weights, partly due to this mode shift. As LTL carriers strive to enhance their profits and shareholder value, they risk losing these longer-haul, larger shipments to the truckload segment.

As always, you can contact your IL2000 Client Services team if you have any questions.

Sources: EIA, DAT, ATA, FreightWaves, Trucking Dive, Yahoo Finance

Published 5/2/2024

LTL AND TL MONTHLY MARKET UPDATE

May 2024

Diesel Prices Hold Steady in April

National average diesel prices were stable in April, just as they were in March. Diesel prices finished the last full week of the month at $3.947/gal, compared to $4.034 /gal at the end of the prior month. This was down $0.05 from the prior week and down $0.13 relative to the preceding year. The EIA has reduced its 2024 projections by $0.05.

.png?width=800&height=533&name=On-Highway%20Diesel%20Fuel%20Prices%20(16).png)

April spot rates holding at record lows

April spot rates showed no signs of reversing their downward trend for both van and reefer, with a marginal increase for flatbed. Projections indicate more of the same in the near term. As produce season kicks off, historical rates typically begin to increase. However, the rates are holding flat for the time being. Whether or not spot rates will show any sign of a seasonal spike, particularly for reefers, remains to be seen.

Source: DAT

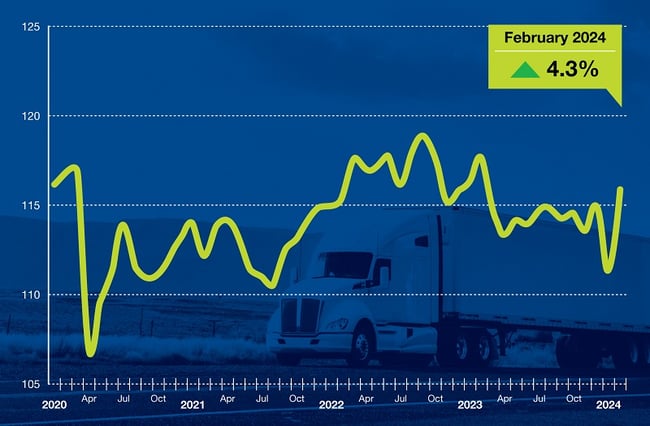

Truck tonnage index down 2% in March

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased by 2% in March after increasing by 4.3% in February. The index is down 1% from March 2023, suggesting the freight recession remains after thirteen consecutive months of year-over-year decline.

Source: ATA

News from around the industry

Estes to open at least 20 freight terminals in 2024

Estes plans to open 20 out of the 24 terminals purchased from Yellow in 2024. Eight of those facilities are projected to be operational by the end of June. These 20 facilities will increase Estes’ operation by 985 doors across their national network. Saia and XPO are also in the early stages of relaunching former Yellow terminals into their networks. (Source: FreightWaves)

AI attacks are becoming more common in the logistics industry

Cyber-attack attempts are becoming rampant as AI makes them easier to attempt and more effective. AI attacks are becoming more prevalent in the logistics industry. Estes experienced a massive attack earlier this year, shutting down their systems completely. Shortly after Estes recovered, regional carrier Ward was attacked and victimized. (Source: SupplyChainBrain)

US carriers illegally hiring Mexican drivers, sources say

Carriers are urging authorities to investigate what they believe is the rampant misuse of Mexico-based B-1 Visas. These Visas are meant to prevent foreign nationals from competing with US truckers in loads within the United States. Companies are allegedly setting up cross-border operations to get Mexican drivers to haul northbound cross-border shipments into the US, which is legal. Once these drivers are over the border, they are illegally assigned intra-US work at significantly reduced pay standards relative to American drivers. (Source: FreightWaves)

The Market Outlook

Many major truckload carriers are posting very poor results following their Q1 2024 earnings calls. J.B. Hunt's operating income is down 30%, PAM Transport posted a 104.2% operating ratio, Heartland Express posted a 105.3% operating ratio, and both Schneider and Knight-Swift cut their 2024 projections. As costs continue to increase, there is still excess capacity pinning rates to the floor. Demand is still soft, but the beginning of produce season and summer holidays on the horizon historically strengthen freight demand.

We will be here for you no matter what the future holds for LTL and Truckload.

As always, you can contact your IL2000 Client Services team if you have any questions.

Sources: Reuters, EIA, DAT, ATA, FreightWaves, SupplyChainBrain

Published 4/4/2024

LTL AND TL MONTHLY MARKET UPDATE

April 2024

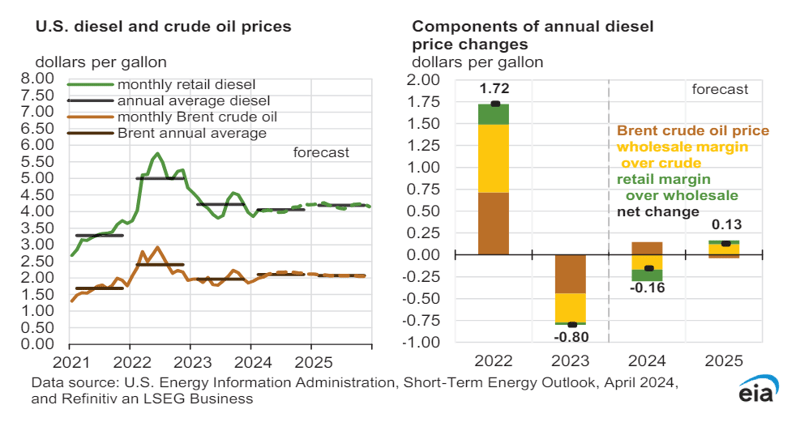

March sees stable Diesel Prices, EIA adjusts 2024 forecasts upward

The national average diesel price was stable in March relative to February, finishing the last full week of the month at $4.034 /gal, compared to $4.058 /gal at the end of the prior month. This was down $0.01 from the previous week and down $0.094 relative to the preceding year. The EIA has increased its 2024 projections by $0.09.

.png?width=800&height=533&name=On-Highway%20Diesel%20Fuel%20Prices%20(15).png)

March spot rates continue downward trend

March spot rates declined for both van and reefer, with a marginal increase for flatbed. April projections indicate more of the same, pinning rates at continuing historical lows. Reefer rates have seen the most significant year-to-date decline of $0.21 per mile. Van rates are down $0.14 per mile, and flatbed rates are slightly up $0.03 per mile year-to-date.

Source: DAT

Truck Tonnage Index snapped back in February but remains down

The American Trucking Association’s advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index increased by 4.3% in February after decreasing by 3.2% in January. Even though tonnage has rebounded in the short term, the index is still down 1.4% from the previous year, suggesting the freight recession remains.

Source: ATA

News from around the industry

TFI acquires LTL carrier Hercules Forwarding

TFI International has added Hercules Forwarding to its stable of LTL carriers, which already includes TForce Freight (Formerly UPS Freight and Conway), TST-CF Express, and Kindersley, among several others. The acquisition will add 31 terminals and $100 million in annual revenue to their portfolio. TFI posted the worst LTL operating ratio among publicly traded LTL carriers in Q4 2023. Hercules is positioned in premium markets specializing in high-value freight, which they hope will help boost their operating ratios. (Source: FreightWaves)

LTL update: Enter the post-Yellow world

It’s been nine months since the collapse of the 3rd largest LTL carrier, Yellow Corp. The news has dominated all headlines since then, but we're starting to see what a steady-state market looks like. LTL carriers have remained disciplined with their pricing and are projected to do exceptionally well for the remainder of 2024. LTL is now the most profitable sector of the $900 billion trucking industry. Tonnage has remained light, and if the freight recession ends, we could see rates increase rapidly. There is less capacity than ever, and the incredibly high barriers to entry in LTL make it impossible to scale quickly. (Sources: SupplyChain247)

Baltimore bridge collapse pressures key trucking lanes

The collapse of the Francis Scott Key Bridge will have ripple effects throughout all sectors of the logistics industry. The Port of Baltimore is a unique port specializing in specific verticals, particularly the auto industry. Baltimore is a large flatbed market specializing in large machinery and equipment. As the ships are routed to other ports, the established pricing is being adjusted to move equipment to meet demand as lanes change. The bridge also serviced massive logistics operations in Sparrows Point, which will have to reroute around the entirety of Baltimore. Hazmat haulers also preferred the bridge as an alternate route to avoid traffic during peak haulers as they’re not allowed through the I-895 Harbor Tunnel. (Source: TruckingDive)

The Market Outlook

The LTL and TL markets are currently diverging in terms of profitability and financial performance. Truckload rates are historically low and have remained so for over a year. On the other hand, LTL rates are the highest they’ve ever been and will likely continue to rise as carriers remain disciplined in pricing. Now that Yellow is gone, fewer carriers are chasing freight with reduced rates. Unlike truckload, opening an LTL operation is extraordinarily expensive and time-consuming, so as demand rises, so will rates. We are seeing long-term shipper-carrier relationships end and new ones created as shippers and 3PLs are forced to explore other partners to mitigate rate increases below double digits.

We will be here for you no matter what the future holds for LTL and Truckload.

As always, you can contact your IL2000 Client Services team if you have any questions.

Sources: Reuters, EIA, DAT, ATA, FreightWaves, SupplyChain247, TruckingDive

.png?width=800&height=532&name=month%20report%20images%20(10).png)

Published 3/4/2024

LTL AND TL MONTHLY MARKET UPDATE

March 2024

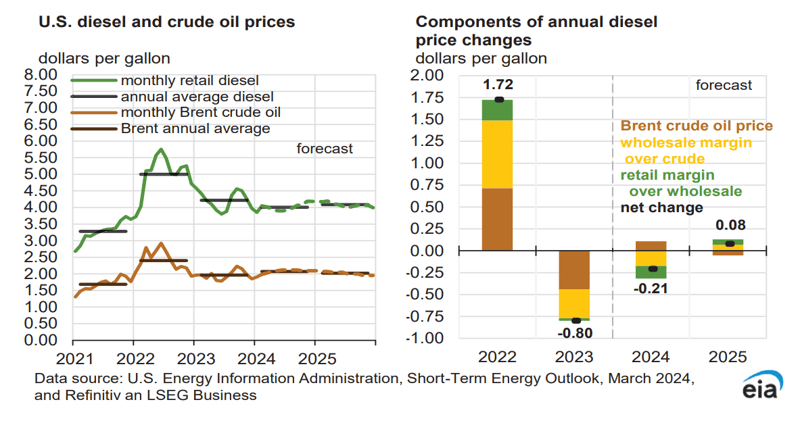

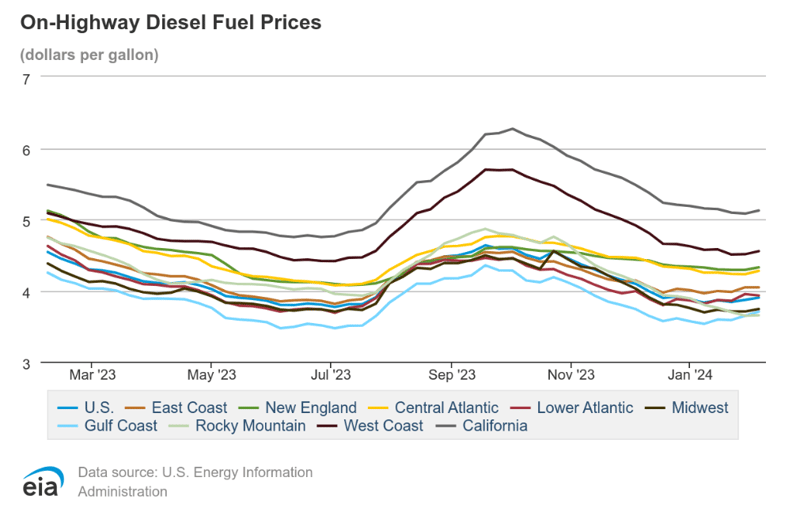

Diesel prices increased in February compared to December and January

In February, national average diesel prices rose compared to December and January, ending the month at $4.058 per gallon. This is an increase from last month's ending rate of $3.867 per gallon, though it marked a $0.05 decrease from the week before and a $0.236 drop from the same time last year. Additionally, the Energy Information Administration (EIA) lowered its diesel price forecast for 2024 by $0.03.

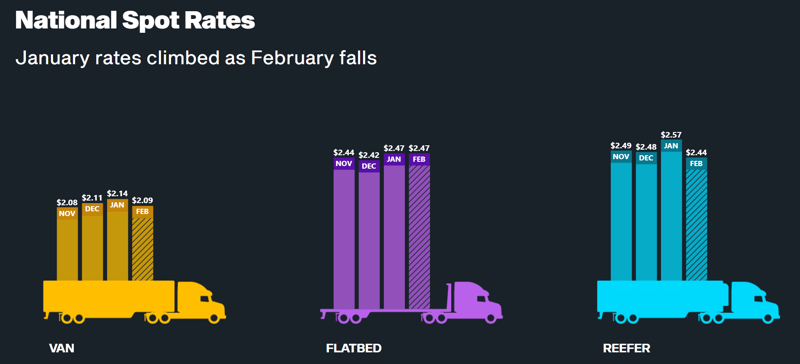

February spot rates negate January increases

In January, there was a slight increase in the spot rates for full truckloads across all types of equipment, with refrigerated assets seeing the most significant rise. However, by February, the rates had returned to the low levels previously seen in the third and fourth quarters of 2023. Despite the ongoing freight recession, characterized by excess capacity preventing rate increases in the near term, new carriers continue to enter the market, optimistic about a potential surge in freight activity by late spring.

Source: DAT

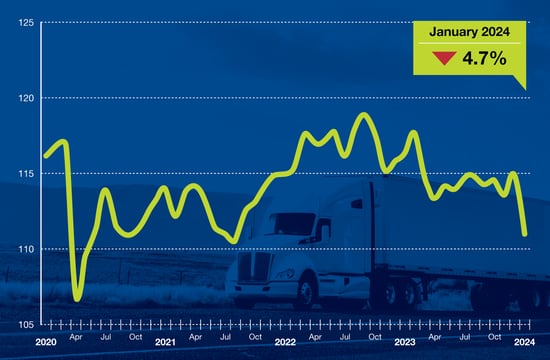

Truck Tonnage Index January data shows no sign of freight recovery

The American Trucking Association's advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased by 3.5% in January after increasing by 1.2% in December. This is 4.7% below January 2023. “January’s data was a snap back to reality for anyone thinking the freight market was about to turn the corner,” said ATA Chief Economist Bob Costello.

Source: ATA

News from around the industry

XPO shares jump 18% on big Q4

XPO outperformed expectations in Q4 across major financial benchmarks. Year-over-year revenue was up 9%, yield was up 10%, on-time service was up 300 basis points, and claims were at an all-time low. XPO is seeking pricing increases in the mid-teens supported by their service improvements. IL2000 data shows significantly more modest service improvements, which may indicate the gains are driven by the influx of new freight from the Yellow bankruptcy instead of incumbent business. (Source: FreightWaves)

2023 freight market was five years in the making

If you’re a truckload carrier or owner-operator, 2023 was potentially one of the worst years in your company’s history. The pandemic created a perfect storm for the long-term freight recession we’re seeing today. During that time, fuel prices plummeted, rates soared, and capacity boomed. Shipper inventories were steadily increasing, but this buildup rapidly collapsed, disappearing almost as quickly as it had accumulated. Carriers are still working to correct size while maintaining a state of readiness for when the freight eventually does return. (Sources: DAT)

Estes angles for growth in Canada with Yellow terminal acquisitions

Estes is currently the second largest holder of former Yellow real estate behind XPO. When you look at the location and scope of these facilities, there is a clear focus on the Northbound corridor locations into Canada, with facilities in Detroit, Buffalo, Burlington, and Tacoma. In addition to focusing on Canada, Estes targeted dock door increases in markets they already serve. (Source: TruckingDive)

The Market Outlook

As we enter the final stretch of the first quarter of 2024, the markets have been relatively steady and quiet across both truckload and LTL. LTL carriers are posting solid financial results due to favorable market trends stemming from the events of 2023 and fewer carrier options than ever before. Carriers are budgeting for aggressive expansion plans to improve market share and balloon Capex real estate allocation. Carriers will be more focused on service to try and pass those costs on to the customer with yield improvement, but first, they will need to justify it.

We will be here for you no matter what the future holds for LTL and Truckload.

As always, you can contact your IL2000 Client Services team if you have any questions.

Sources: Reuters, EIA, DAT, ATA, FreightWaves, Supply Chain Dive, CNBC

Past Domestic Market Reports

Published 2/7/2024

LTL AND TL MONTHLY MARKET UPDATE

February 2024

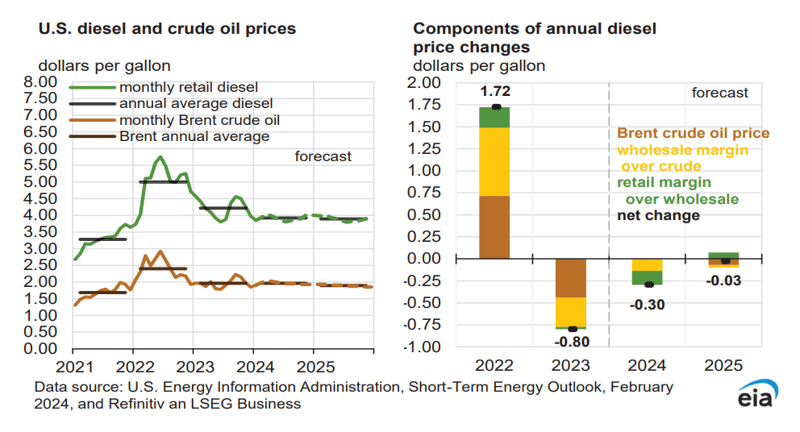

Diesel prices began to rise in January, greater growth on the horizon

On-Highway Diesel prices appear to be entering a growth phase. US-wide diesel prices are up $0.032 from the final reporting week of January 2024 and continued in early February. A similar trend exists across all major markets, and some industry insiders, according to Reuters, point to a sharp incline in fuel costs in 2024. These rising prices will lead to more volatility across fuel surcharges, creating more opportunities for over- or under-billing among carriers. Still, overall volatility is expected to be minimal, depending on how the events of the Red Sea evolve in the coming months.

February spot rates show rebuke of initial projections

Rates for van, flatbed, and reefer in January appeared to recover slightly, following some variability in Q3 2023. However, spot rates are forecast to remain at or below January levels through February. Specifically, van rates are projected to fall by a nickel while reefer rates decline by $0.12.

The rate variability may closely relate to weather changes associated with the Arctic blasts of late January and atmospheric river phenomena of early February. Still, capacity remains in question as equipment worries grow in response to extended global container transit time due to the world’s major canal troubles of 2024.

Source: DAT

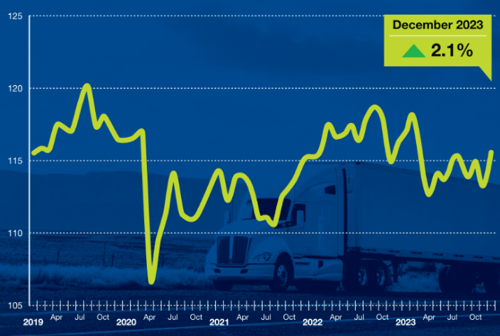

Truck Tonnage Index shows a slight recovery, caution remains

The American Trucking Association's advanced seasonally adjusted For-Hire Truck Tonnage Index increased 2.1% in December after falling 1.4% in November. The 2.1% increase for December puts demand in line with January 2023 and 2022. Still, the current reading solidified 2023 as the worst year since 2019.

If the market is genuinely resetting, as some experts have surmised, we’ll likely see gains in the index throughout the remainder of Q1 and well into Q2. Global disruptions could further push the index higher, too.

Source: ATA

News from around the industry

UPS Looks to Sell Off Coyote, Make Job Cuts

Coyote Logistics, the truckload brokerage arm of UPS, is experiencing trouble as we move further into 2024. UPS is considering selling the business, and the industry giant plans to cut 12,000 full- and part-time management and contract jobs throughout the year. The news is surprising as we're only nine years past UPS' acquisition of Coyote, but as demands changed in 2023, it's struggled to survive.

The volatility in the market has pushed UPS to shore up its endeavors and look to alternatives. The possible sale also is a reminder of when UPS sold UPS Freight, its LTL arm, to TFI International Inc. While UPS has successfully diverted volumes from Coyote into other networks, it’s imperative for all shippers using Coyote to have a backup plan should the enterprise experience a Yellow- or Convoy-grade showdown or stop. (Source: FreightWaves)

Red Sea Disruptions Lead to Equipment Shortages in the States

The effects of attacks on commercial vessels in the Red Sea may seem to have little impact on US trade. However, news reports indicate that the risk is moving closer to home. Carriers have been forced to reroute ships around the Horn of Africa, adding weeks to the typical global cycle of a single ship.

European retailers are further indicating possible delays in the launch of spring merchandise lines. Some media outlets, including CNBC, reported container rates surpassing $10,000 per 40-foot container in mid-January. The disruptions are inevitable and coming for US manufacturers; even though it may seem far-fetched now, manufacturers sourcing raw materials or components from Asia could be impacted. The most notable would be those receiving imports from Asia to the East Coast. But again, it’s a double-edged sword.

West Coast importers looking to receive trans-Atlantic freight could be faced with the challenges arising from the delays at the Panama Canal. It’s a problem almost everywhere, excluding trans-Pacific freight headed to the West Coast and trans-Atlantic freight headed to the East Coast.

NRF has also said that rail dwell times are increasing as shippers look to leverage transcontinental rail as an alternative to the issues, leveraging trans-Pacific transportation where possible. The added costs aren’t regaled to transit time but total emissions in the value chain and backups that could arise from other compounding factors. Regardless, all retailers should be mindful of both intermodal rates and port congestion deriving from this newfound disruption. (Sources: Supply Chain Dive & CNBC)

Spot & contract rates move toward convergence

The spread between spot and contract rates among dry van truckloads appears to be tightening. The values are the most balanced, read “closer in value,” than they’ve been since last Halloween, but as the values switch places, capacity grows more problematic to find.

Such variability means the market may be moving toward a position where carriers gain bargaining power in negotiations again.

Shippers may need to consider new mini-bids or short-term dedicated solutions to find capacity. The data also compares to the ongoing van outbound tender rejection rate index (VOTRI). The combined insight shows that shippers must be cautious and prepare for a tightening of capacity. (Source: FreightWaves)

The Market Outlook

The predictions from our January report on the LTL market will take longer to come to fruition. LTL carriers are budgeting for record levels of capital expenditures, particularly in their real estate. The Yellow real estate is proving to be more expensive to procure and overhaul than expected. Initial reports indicate that they plan to offset these increases in the short to medium term with continued rate increases.

At the same time, we’ve seen major closures occur, and now, with the uncertainty over Coyote, time may rewrite the story. Major LTL providers have added more lanes and dock doors, and some companies have implemented new technologies designed to leverage available capacity better. These advancements are easing the capacity crunch but at an increased cost, which will be passed to shippers.

In contrast, the truckload market seems to be moving to favor carriers and transportation suppliers, i.e., trucking companies. But there’s an even more significant side to the story.

The Logistics Managers’ Index (LMI) has been expanding for five of the past six months. The index rests on a scale with a gridlock, stale market measure of 50. Rates over 50 indicate growth, but those under 50 show contraction. The index shows that transportation capacity is growing (54.5) but is 8.8 points lower than the December level. Similarly, transportation prices have jumped 12.7 points to 55.8.

The essence of the index is the continued above-50 rate for the primary metrics in the index. Further, inventory levels are 52.8, and inventory costs are 66.8. Together, the metrics point toward a looming end to the Freight Recession. However, there’s still much to be discerned as to whether the industry insiders at FreightWaves will proclaim a full stop to the events and horrors of the past year’s market.(Source: FreightWaves)

Of course, the instability caused by geopolitical change, potential weather influences, new regulations in core states, e.g., California, and even the 2024 election cycles could influence buying habits and lead to a sudden strain on capacity.

Some constraints may also come to light as the Lunar New Year leads to added delays in southeast Asia through the end of February. If the worst, a sudden uptick in consumer demand, should occur, there will be an immediate uptick in rates and a drawdown on available assets. Shippers should take heed now and implement partnerships that will provide a protective effect regardless of what the market has in store.

We will be here for you no matter what the future holds for LTL and Truckload.

As always, you can contact your IL2000 Client Services team if you have any questions.

Sources: Reuters, EIA, DAT, ATA, FreightWaves, Supply Chain Dive, CNBC

Published 1/5/2024

LTL AND TL MONTHLY MARKET UPDATE

January 2024

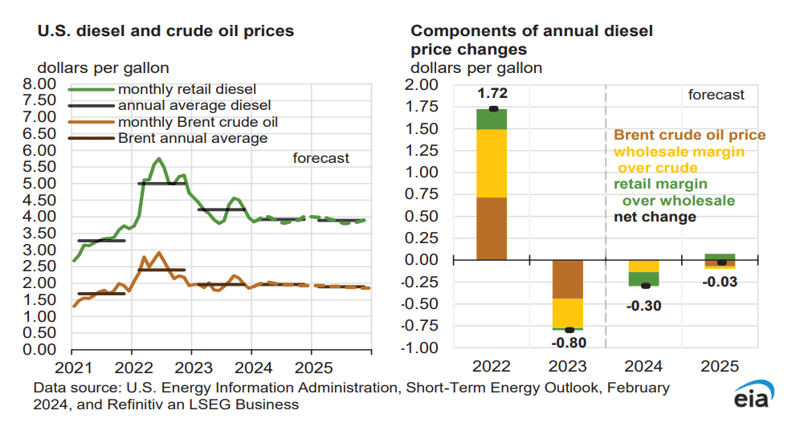

Diesel prices continue decline throughout December

National average diesel prices continued their downward trend throughout December, finishing the last whole week of the month at $3.914 /gal compared to $4.146 /gal at the end of the previous month. This was up $0.02 from the prior week and down $0.623 relative to the preceding year. The EIA has significantly lowered its 2024 projections by $0.26 per gallon due to the soft rates at the end of 2023.

Source: EIA

Source: EIA

January spot rates projected to improve

After weak rates in both November and December, January projections are finally trending upward. However, these forecasts are based on earlier predictors and can change as additional data is gathered. Van and flatbed rates are projected to improve by $0.03 per mile. Reefer rate is projected to gain $0.07 per mile. Tighter capacity during the shorter holiday weeks helped boost the pricing before closing 2023.

Source: DAT

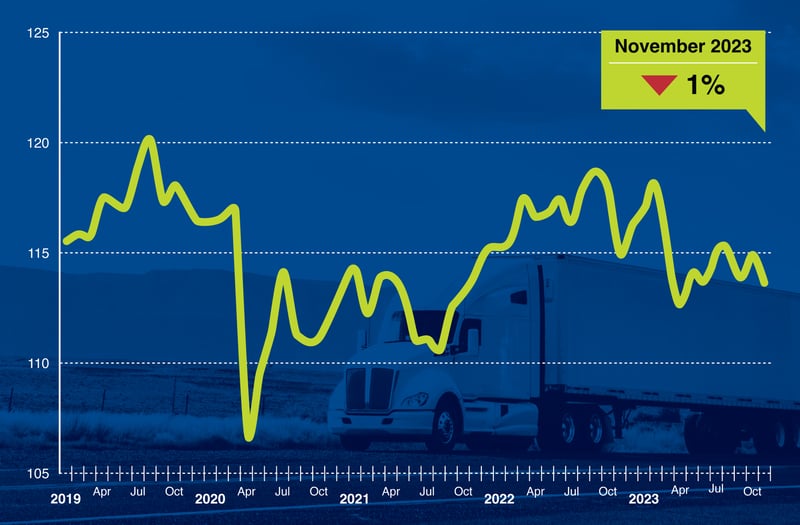

Truck Tonnage Index sporadic behavior continues

American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased by 1% in November after increasing by 1.1% in October. This is 1.2% below November 2022. Tonnage has been sporadic all year, but the ATA’s Chief Economist, Bob Costello, “Isn’t expecting any surge in freight levels in the coming months.”

Source: ATA

News from around the industry

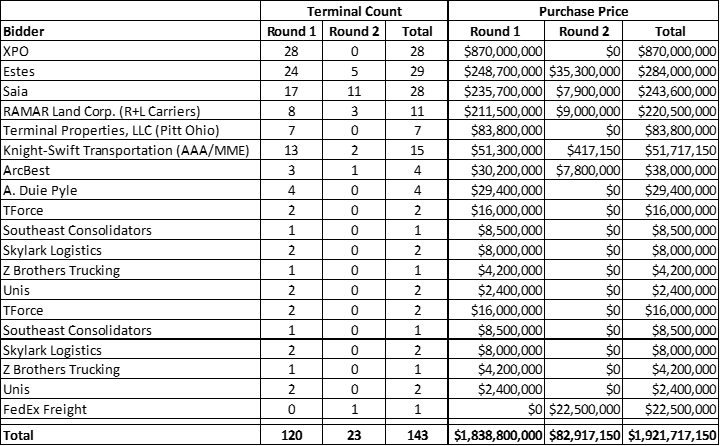

Auction moves 2nd lot of Yellow terminals

The first lot of Yellow terminals were auctioned off, and the bidders were revealed on December 1, 2023. A few weeks later, the 2nd tranche of real estate was auctioned off. Below is a summary of the bidders by round. Notably absent was Old Dominion. They may be pursuing real estate via other means or have deals in process with active bidders. XPO was the largest bidder at $870M. (Source: FreightWaves)

December manufacturing output declines to end 2023 reports ISM

Despite a slight uptick in December, manufacturing output was well below the required metrics that would signal growth. The ISM’s Manufacturing Report on Business benchmark, PMI, was 47.4 (50 or higher signals growth). This is the 14th consecutive month of contraction. The only sector signaling growth was primary metals. (Source: SupplyChain24/7)

UPS and FedEx’s Tough Year

UPS and FedEx faced challenges across multiple fronts in 2023. Both carriers had to take measures to "right size" their operations. Soft demand led to price deterioration as carriers grappled for volume. Price increases were smaller than usual, which carriers tried to offset with increases in fuel surcharge. For carriers, fuel surcharges are an additional source of profit, so weak fuel prices impact overall margins.

(Source: SupplyChainDive)

Market Outlook

2023 was another year of change in the LTL market. Whether through bankruptcy, acquisition, or merger, capacity is now spread across fewer carriers than at any point in recent history. As this capacity is retooled and brought up to speed, the market should expect to return to a more favorable position for shippers. Shippers have grappled with price increases and weaker service for the past three years. Barring any major shake-ups, shippers should be in a more favorable position by the end of the first quarter of 2024.

For truckload, 2023 was a year many in the industry would rather forget. Prices never increased to year-over-year gains, and the usual spikes in prices during the year never materialized. Several truckload brokerage operations had to close their doors as a result. Excess capacity, low tonnage, and historically weak pricing linger in the marketplace. Unless one of these factors swings the other way, truckload pricing shows no sign of improving in the near term.

We hope you had a wonderful Holiday season.

As always, you can contact your IL2000 Client Services team if you have any questions.

Sources: EIA, DAT, ATA, FreightWaves, SupplyChain24/7, SupplyChainDive