Asked to list their greatest concerns for 2021, three in four CFOs report reduced profitability as their company’s biggest challenge, according to a recent Gartner global survey. That businesses are more concerned today about their future is probably not all that surprising. However, the sharpness of that concern, coupled with a pervasive uncertainty of what to do about it, is striking.

Case in point: Fewer than one in four respondents in the Gartner survey reported a company reliance on product line innovation to improve productivity. Over sixty percent, meanwhile, identified passing on costs to their customers as their principal response.

In the wake of what feels like a relentless barrage of financial uncertainties — wage inflation, burgeoning freight costs, and depressed customer demand to name just a few of the usual suspects — businesses worldwide are struggling to find their way to a leaner, meaner budget. Leaning into some quick supply chain fiscal fixes here and there may resolve budgetary pressures for a time, but companies are now coming face to face with the longer-term, structural implications of running a tighter ship.

And that leads, inevitably, to the trickier question of where to cut; and how best to optimize your budget. That’s exactly why business intelligence tools exist–to find the low-hanging opportunities for optimization. In this article, we take a closer look at how to tackle your budget optimization process, focusing on three critical pain points: building an effective budgeting strategy, knowing how lean is too lean, and investing in your critical partnerships.

Shifting from reaction to strategy

Reflexively passing costs along to customers as production costs increase is a risky business. But shifting that reaction to a mature pricing strategy becomes a balancing act.

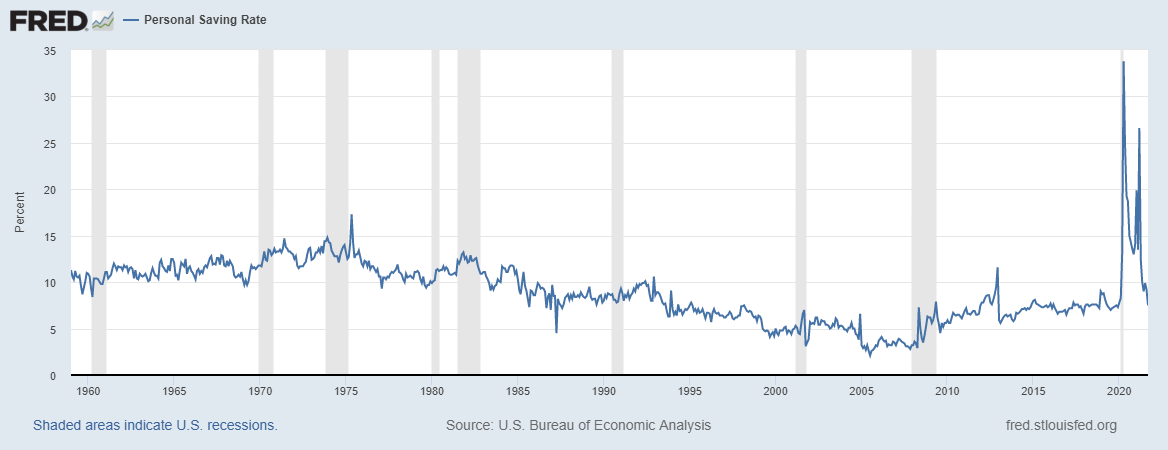

On the one hand, consumers across the board saved money during the pandemic. The US personal saving rate leaped to over thirty percent in April 2021— up from around 13 percent in March, the US Bureau of Economic Analysis reports. The economy slowed down, and companies may feel inclined to bank on a surge of demand to inflate prices as spenders slowly find a New (conspicuously consuming) Normal.

On the other hand, customer price sensitivity is a complex and shifting equation. A host of factors play into your customers’ perception of your product’s value — from your competition’s product pricing decisions, to how your product line stacks up against the basket of everyday goods people buy simply to subsist.

“It would be bad practice to reflexively pass costs onto customers without first assessing whether input price inflation is transitory,” Gartner concluded in the above-cited survey.

The impetus to reflexively react to increasing costs is also happening at a supply chain level. Retailers are reducing their product lines in an effort to push their budgets in the right direction. Simultaneously, many vendors — particularly those selling smaller necessity goods — are scrambling to cater to unexpected surges in demand, often resorting to purchasing from larger retailers to accommodate their shortfall.

Interviewed for Supply Chain Dive, Jake Bolling (CEO of distribution platform Skupos) cautioned against this kind of reactiveness, stressing that these short-term influenced responses all serve to compress a company’s margins. “Retailers should understand their local buyers and ensure there are enough of the favorite core products,” Bolling said.

Twitch less. Deliberate more.

To paraphrase Bolling’s and Gartner’s analysis, then, the budget optimization challenge of our time is to twitch-respond less, deliberate more. Whether in price setting or rationalizing your product line, a crucial early mind shift in optimizing your budget is to abandon reflexive and reactive decision-making. Instead, invest in deepening your understanding of your customers’ price sensitivity, and concentrate on ensuring an uninterrupted supply of your core products.

Knowing how lean is too lean

Companies everywhere have had to face up to the unenviable task of cutting personnel costs. And of course, that leads inevitably to a shrinking workforce. But how lean is too lean? The balancing act here is no less brutal than price-setting in an unstable market.

Wage and salary costs typically account for over 70 percent of total business costs, according to September 2021 data released by the US Bureau of Labor Statistics. Clearly, any meaningful company push to shrink a budget must tackle its workforce. But impoverishing your pool of talent to hit an arbitrary budget target hardly positions a company for lasting success.

Moreover, with each layoff, a company has one less mind within its ranks to foster innovation. It has one fewer resource to draw from to generate agility and maintain vital company relationships. An important part of the solution may lie in making smarter decisions about recruitment.

There are currently over 27 million people who classify as “hidden workers,” Harvard Business School states in its October 2021 workforce analysis, Hidden Workers: Untapped Talent. Among this vast number are hybrid workers who can relocate to less expensive areas, short-term freelancers with deeply customized skillsets, and a vast workforce of flexible remote workers.

Instead of working with fewer people, HR departments may find budget optimization solutions simply by considering different kinds of candidates.

The challenge of deciding how lean is too lean has a similar shape at a supply chain level.

“Introducing new products into the market only makes sense if a brand can achieve 50 percent distribution,” Bolling said in his interview with Supply Chain Dive. “If the product doesn’t meet this mark, it should be cut immediately.”

From a product standpoint, finding the right level of budget optimization may boil down to making difficult decisions about which products fall within your core portfolio, and which ones do not. Removing outlier and supporting products from your product line reduces your manufacturing costs — an obvious benefit in lean times. But it also simplifies your supply chain.

Lean needn’t mean emaciated

“We’ll have to make cuts” is the all-too-common refrain when profit lines tighten. But there is a point at which leanness tips the scales and threatens to critically hamper your capacity for growth. Whether you’re reassessing your personnel, your product line, or your logistics, the deeper challenge of optimizing your budget is to carefully consider where that line lies.

Investing in partnerships

In any situation of uncertainty, it’s a basic human impulse to “batten down the hatches.” Partnerships and alliances can fall by the wayside as businesses clamor to keep their slice of the pie.

“The world has become a less trusting place,” Deloitte Insights asserts in The link Between Trust and Economic Prosperity, a 2021 analysis of trust in the global economy. Citing a World Values Survey, Deloitte continues that “The share of the global population that believes ‘most people can be trusted’ fell by roughly 20 percent over the last 15 years.”

Both macroeconomic and business figures leave little doubt that an erosion of trust in business partnerships is marching in the wrong direction. One Deloitte-cited meta-analysis of business sector attitudes to trust found that a ten percent increase in trust-based behavior raises per capita GDP real growth by half a percent — a vast increase when you consider that total GDP growth averaged just over two percent between 2015 and 2019. Down at the business level, a 2021 Accenture global survey of over 30,000 consumers found that 62 percent of customers actively seek out companies with an outward focus on fair employment, transparency, and sustainability.

At a product and sales level, maintaining an open line of communication with your customer base about your pricing strategy may serve to boost how consumers see and value your product. It’s counter-intuitive -- and an uncomfortable prospect for many marketing departments! -- but one crucial step of budget optimization and product pricing may simply be not to perform that process from behind closed doors.

From a supply chain standpoint, a more efficient budget may begin with building trust with distribution partners. Making capital investments in suppliers, seeking volume-based discounts, and guaranteeing continued business to the companies that keep your supply chain running may serve to alleviate margin pressures on both sides.

Avoiding the zero-sum game

The process of shaping a businesses’ budget to stay afloat may feel, intuitively, as though it should be an inward-looking process. But the data shows us that pursuing self-interest and “going it alone” isn’t the optimal fiscal solution. In fact, it can be a zero-sum game. Focusing on building your critical partnerships and fostering trust with your customer base may give your company a smoother road to budget optimization.

Get in the freight budget optimization mindset with IL2000

It’s been an uncertainty-filled few years, and businesses worldwide are scrambling to find the right budgetary response. Returning briefly to the Gartner survey and those statistics we cited earlier: Consider that less than 25 percent of respondents talked about innovation as a way to improve productivity. Over 60 percent, on the other hand, identified passing on costs to their customers as their company’s go-to reaction.

A lot of factors are undoubtedly at play here. But part of an explanation for this preference may simply be that companies, like people, react to new pressures before considering all the implications.

Shifting from a budget cut to a budget optimization mindset is a challenge on many fronts, but it’ll likely call for smart and reflective strategy, finding new approaches to doing more with what you have, and doubling down on building trust with your essential partners — from your customers right through to the businesses handling your freight and logistics.

Optimize your budget and supply chain strategy by choosing IL2000 now. Connect with an expert in supply chain optimization at IL2000 to get started.