IL2000 White Paper Series

Want a more cost-efficient and reliable trucking supply chain?

Two strategies that are transforming shipping

WANT A MORE COST-EFFICIENT AND RELIABLE TRUCKING SUPPLY CHAIN?

TWO STRATEGIES THAT ARE TRANSFORMING TRUCKLOAD SHIPPING

Truckload market rates are in a state of constant flux. Your shipment’s destination, seasonal fluctuation, weather patterns, overall freight demand, and other slippery variables all combine to make truckload freight optimization a formidable analytical task. Moreover, there’s no guarantee that the carrier who offers the best rate on one shipment can offer the most competitive rate on the next.

Truckload rate market volatility has always been, more or less, a supply chain reality. But the stakes look to be considerably higher in 2021 and beyond. Your business today is making trucking freight decisions in a rising rate environment.

Take a look at some trend lines we’re seeing in the September 2021 Market update:

- Diesel is up 27.5% YOY from $2.43 in August 2020 to an average of $3.35 per gallon in the last week of August 2021.

- Truckload contract rates are up 19.5% YOY when adjusted for fuel from $1.98 per mile in August 2020 to an average of $2.46 per mile in August 2021.

- Truckload contract rates have risen above SPOT rates for the past three months, signaling that shippers and 3PLs are taking a permanent rate increase to secure capacity.

Ongoing COVID-19 impacts, continued fuel supply problems, and the legacy of West Coast port congestion all point to continued rate increases and capacity challenges throughout 2022.

If you haven’t already done so, now is likely the right time to reappraise your truckload shipping strategy.

The traditional approach (and why it’s no longer enough)

Shippers have traditionally used one of two capacity solutions to optimize their truckload shipping budget.

Rate shopping

The shipper requests quotes from multiple carriers for each new shipment.

- The draw: With rate shopping, a shipper essentially pays closer attention to every transaction, using market competition to secure the best deal.

- The drawbacks: Rate shopping is time-consuming and labor-intensive. Also, this approach introduces more significant uncertainty. In any situation where carrier capacity tightens (a dominating characteristic of the market in 2021), the rate shopper may be unable to ship. Or they may damage their organization’s profitability with steep transport premiums.

Contract rates

The shipper negotiates a set contract rate with one or more carriers.

- The draw: By building their logistics on contractual rates, shippers gain a greater level of predictability in planning and some measure of protection against capacity shortages and market-based price hikes.

- The drawbacks: The chief drawback is cost. Contract rates typically hover at around 15 percent above spot market rates. Protecting yourself against market surges exposes a shipper to the equal and opposite risk of paying too much when the market softens.

Finding better truckload capacity solutions

In today’s economic environment, both of these either-or solutions are blunt instruments filled with difficult trade-offs. Partly in response to market pressures today, partly in anticipation of where the market will be 12 months from now, shippers are looking for more granular solutions.

Two overlapping strategies are emerging:

- Lane segmentation: Choosing from a suite of truckload capacity and price models, carefully calibrating risk and reward to a shipper’s high, mid, and low volume lanes.

- Data-driven logistics: Investing in improved visibility over every aspect of how a shipper moves its products. The goal: To make smarter, more responsive shipping decisions.

1. Lane segmentation

A traditional approach forces shippers to choose from one of two strategies. Standardize your pricing, sometimes paying more than you should. Or speculate — investing significant time on every transaction, sometimes weathering significant uncertainty in the process. The point of lane segmentation is to craft a best-of-both-worlds approach.

High-volume lanes

A high-volume lane is typically consistent and predictable, characterized by efficient round trips and ease of planning.

Shippers increasingly seek a dedicated trucking fleet to secure a reliable, high-quality, and cost-effective service for high-volume lanes. A dedicated or private fleet equips shippers with several critical known quantities: A fixed number of trucks and drivers, predictable rates, and a fixed delivery schedule. A higher degree of certainty against these variables supports growth and gives a shipper greater control over their service.

Reflecting the industry’s growing awareness of the advantages of running a dedicated fleet, there has been over a ten percent decline in truck count for one-way truckloads among the industry’s top carriers in recent years. Over the same period, there has been an almost seven percent increase in truck count committed to dedicated operations, according to DCVelocity.

Mid-volume lanes

Mid-volume lanes are of moderate to higher density traffic, but the lane may be subject to fluctuations (seasonal, demand-based, or otherwise). The shipper may be unable to guarantee a steady freight volume via their mid-volume lanes.

Contracting mid-volume lanes to a third-party carrier increases price stability and overall reliability. Contract types offer a fixed rate on an overall lane or a fixed rate per mile. The number of lanes and the number of loads per set timeframe, however, may vary. This flexibility allows shippers to scale trucking freight activities up or down as required.

While a shipper will typically pay up to 15 percent over spot market rates, they’ll gain a significant (though by no means absolute) financial buffering from the turbulence of the volatile shipping market.

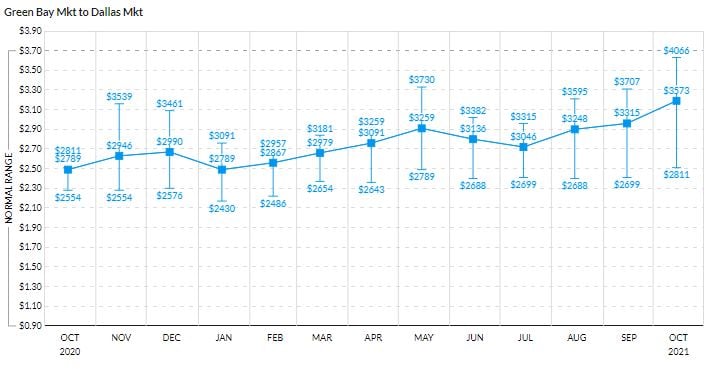

Figure A illustrates a dynamic pricing model. Source: DAT

Low-volume lanes

Low-volume lanes or those whose destination entails cost-efficient point-to-point transit are infrequently required or inconsistent.

It’s important to note that low-volume lanes comprise a large proportion of the total lanes the average shipper needs to manage. An analysis of low-volume lanes across 100 shippers found that, on average, up to 80 percent of a shipper’s lanes account for just 7 percent of their total volume, Dr. Chris Caplice (Chief Scientist for trucking analytics company, DAT iQ) reports for Inbound Logistics. The message here is clear. Low-volume lanes demand a disproportionately high volume of time outlay and investment.

Working with third-party transportation management companies, shippers increasingly use dynamic, market-based pricing for low-volume lanes. Effectively, dynamic pricing sets negotiated guardrails around a shipper’s truckload shipping rate.

This capacity solution will save a shipper’s time and afford them more bandwidth to focus on their critical lanes. But it also combats their shipping diseconomies of scale. A 2018 study showed that market-based pricing outperformed benchmarked management rates by over 11 percent.

Figure A: A dynamic pricing model. Source: DAT

2. A push toward more data-driven logistics

A related strategy is to inject more data into shipping decision-making.

A transportation management company offers shippers greatly enhanced visibility over their truckload pricing, helping them make intelligent, granular decisions about optimizing their shipping strategy. Instead of reacting blanketly to price fluctuations, shippers can leverage customized reporting and business intelligence dashboards to identify and effectively respond to their supply chain pain points.

Gauging the market with industry-wide benchmarks

Shippers are looking at a vast market through a tiny keyhole in the absence of industry-wide data on rates. With only company historical data to draw from, shippers gain limited objective insight into what price fluctuations mean. Moreover, shippers have limited leverage without benchmark data when negotiating rates with carriers.

Third-party transportation management companies equip their clients to forensically analyze how their spending compares with companies operating at a similar scale and across equivalent lanes.

This knowledge equips shippers to negotiate rates with greater confidence and transparency in the short term. In the long term, shippers can use benchmark data to decide when and how to segment their lanes best.

Enhancing situational awareness with historical data

Trends in the shipping market are complex. Rates follow a complicated overlay of upward and downward influences. Some are rigidly time-bound and cyclical, others play out unpredictably, responding dynamically to broad fluctuations in the economy. An accurate read on a market of that complexity requires expertise and an extensive database of historical data.

Third-party logistics companies bring those resources, enhancing shippers' capacity to make agile, responsive, data-driven decisions.

Optimizing resource use and employee bandwidth

Third-party transportation management companies also help shippers by offering greater bandwidth to handle daily administrative tasks like quoting, booking, and shipment tracking. By shifting these operations to a dedicated third-party team, shippers almost instantly transition to a leaner operation.

Additionally, by equipping shippers with highly customizable business intelligence dashboards, logistics can play a stronger and more decisive role in decision-making across every layer of a company’s operations — from data guiding finance and infrastructure procurement right through to equipping customer-facing staff to win sales and offer better customer support.

.jpg?width=800&height=490&name=Demo%20BI%20Dashboard%20(1).jpg)

Example of an IL2000 BI dashboard

Truckload shipping is changing. Are you keeping up?

The world has changed quickly in recent years, and the truckload shipping market has grown in complexity and volatility. A one-size-fits-all approach is becoming increasingly out of step with that reality. And it’s a methodology that fails to give shippers the strategies and tools they need to manage uncertainty effectively.

IL2000 offers these recommendations:

- Consider segmenting your capacity solutions, particularly using dynamic pricing to optimize your capacity spend.

- Build a relationship with a transportation management company that can give you greater visibility into your supply chain. Benchmarks, historical trend data, and dedicated administrative support can position your company to make smarter, data-driven supply chain decisions.