International Monthly Market Update

The latest on requirements, carrier announcements, port operations, and customs updates from around the world.

Published 5/1/2024

INTERNATIONAL MONTHLY MARKET UPDATE

May 2024

On April 5, Maryland Governor Wes Moore signed an executive order providing $60 million to support workers and businesses affected by the Baltimore bridge collapse. Moore is taking steps to help the families who lost loved ones by appointing a liaison to work with the families. In addition, he proposed a permanent scholarship program for the families. Two victims remain unaccounted for.

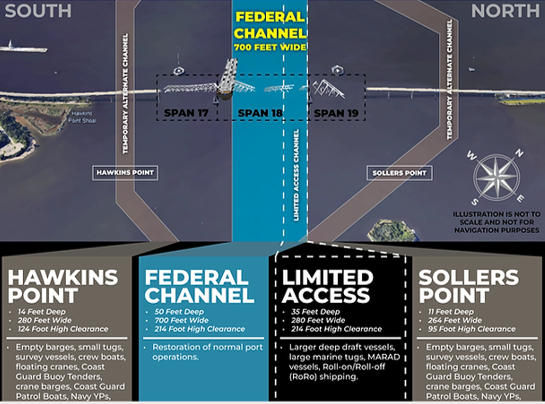

The US Army Corps of Engineers is working to clear the bridge wreckage and to create one passage for access in and out of the port. Authorities advise that they expect a new 35-foot limited access channel to be open in early May. This would allow smaller ships transporting cars and RORO vessels to move through. Larger container ships must wait as they require deeper clearance, and the current access channel will not support them.

Proposed channel access. Image source: ACL (Atlantic Container Line)

The Baltimore Captain of the Port (COTP) also announced another channel at a depth of 20 feet, which will provide limited access for commercially essential vessels. This could potentially allow ocean carriers to operate limited barge services in and out of the port.

Due to the increased cargo volume from Baltimore being shifted to other ports, carriers anticipate vessels bunching up and wait times increasing to two to four days. The current wait times at these ports are:

- New York: 1 to 2 days

- Norfolk: 3 to 4 days

- Wilmington and Philadelphia: no delays

Train derailment

A 35-car train derailed on April 26 at the Arizona-New Mexico border is under investigation. According to the Arizona Governor, as the train was carrying propane and gasoline, the accident was treated as a hazardous materials incident. Luckily, no injuries were sustained.

Source USA Today: A train derailed near Lupton, Arizona, near the New Mexico border on April 26, 2024. Photo source: Arizona Corporation Commission

China News

BCO demand increased heavily in April.

- Pacific Southwest and US East Coast is very tight, with heavy rollover due to increasing blank sailings for May. Blank sailings are currently between 12 and 20%.

- Average wait time at China Base ports is 1 to 2 days.

- Equipment shortages in Tianjin and Qingdao.

Port News

Alphaliner released the 30 biggest global ports for 2023. Shanghai, Singapore, and Ningbo took the top spots, while Los Angeles and Long Beach were ranked number nine.

The Port of Los Angeles recorded its eighth consecutive month of growth, with a 19% year-over-year increase in container handling. In the first three months of the year, the port handled 2.38 million TEUs, a 30% increase over the 2023 units handled.

Carrier News

Tensions between Iran and Israel continue as The MSC Aries, a Portuguese-flagged vessel, was seized by Iran on April 13. Iran’s foreign ministry stated the ship was violating maritime laws, adding they believed the vessel was linked to Israel. The vessel, carrying over 14,000 TEUs, was taken at the entrance of the Persian Gulf at the Strait of Hormuz. The vessel was moving on the HEX service, which operates between India and North Europe, with weekly rotation to Nhava Sheva and Mundra.

MSC Aries. Photo source: Vessel Finder

Air Freight

Amerijet International announced in late April that it is planning to furlough a number of pilots to help increase cash flow. The Miami-based cargo airline is reducing the pilot roster due to lower customer demand and the loss of the US Postal Service contract. The Air Line Pilots Association (ALPA) is working out final details to help mitigate the short-term staffing issues. Additionally, FedEx Express acknowledged they have 700 more pilots than needed, as overnight package demand has slowed.

Air freight volumes have finally rebounded. However, Amerjet is forced to downsize further, affecting their core service to the Caribbean and Latin America.

Cargo operations were disrupted in Dubai when unexpected freak rainfall hit the UAE on April 16. Two years’ rainfall (26cm) hit in one day, leading to flash floods, flooding and the temporary closure of DXB with the cancellation of around 300 flights. This impacted various cargo airlines, including Emirates SkyCargo, which said they faced "operational challenges, including flight cancellations and delays in cargo." Flights have since resumed, and the schedule has returned to normal.

Intra-country transportation was also affected, with many trucks being unable to transport containers from ports like Jebel Ali to the airport.

Source CNN: Vehicles, including cargo trucks, were stuck on a flooded road after a rainstorm hit Dubai, United Arab Emirates) Photo: Rula Rouhana/Reuters

Customs

US CBP’s February monthly operational statistics include:

- More than 2.8 million customs entries processed, valued at more than $275 billion, with estimated duties of nearly $6.2 billion to be collected.

- Ocean accounted for 39.67% of all international entries.

- CBP seized 1633 shipments containing counterfeit goods valued at over $384 million.

- 749 entries were stopped for further examination due to suspicion of being made with forced labor. CBP is the leader in the US government to eliminate goods made with forced labor.

CBP warns of increasing impersonation scams involving individuals posing as CBP employees demanding payment or sensitive information. If you get one of these calls, hang up and report the call to the Federal Trade Commission.

CBP issued an Entry Type 86 fact sheet providing guidance on who may make entries and requirements for brokers. They also warn that bad actors exploit Type 86 entries to traffic illicit goods and circumvent legitimate trade. The data on these entries are limited and vague, and CBP is increasing its enforcement efforts to ensure compliance.

North American Importer groups and brokers sent a letter to Canada's Committee on International Trade warning them that the CARM launch set for May 13 is not ready. They cited a low number of fully certified participants and ongoing incorrect calculation of duties and taxes in CARM.

The international team is here to help with your logistic needs! Making Logistics Happen! international@il2000.com

Sources: FreightWaves, ACL Lines, Alphaliner, Shipco, cbp.gov, Maersk, Reuters, Journal of Commerce, Sinpex, USA Today, Vessel

Finder, CNN

Published 4/1/2024

INTERNATIONAL MONTHLY MARKET UPDATE

April 2024

In the early morning of March 26, the Singapore-flagged vessel Dali struck the Francis Scott Key Bridge in Baltimore. Our sympathy goes out to all affected by this traffic incident and their families.

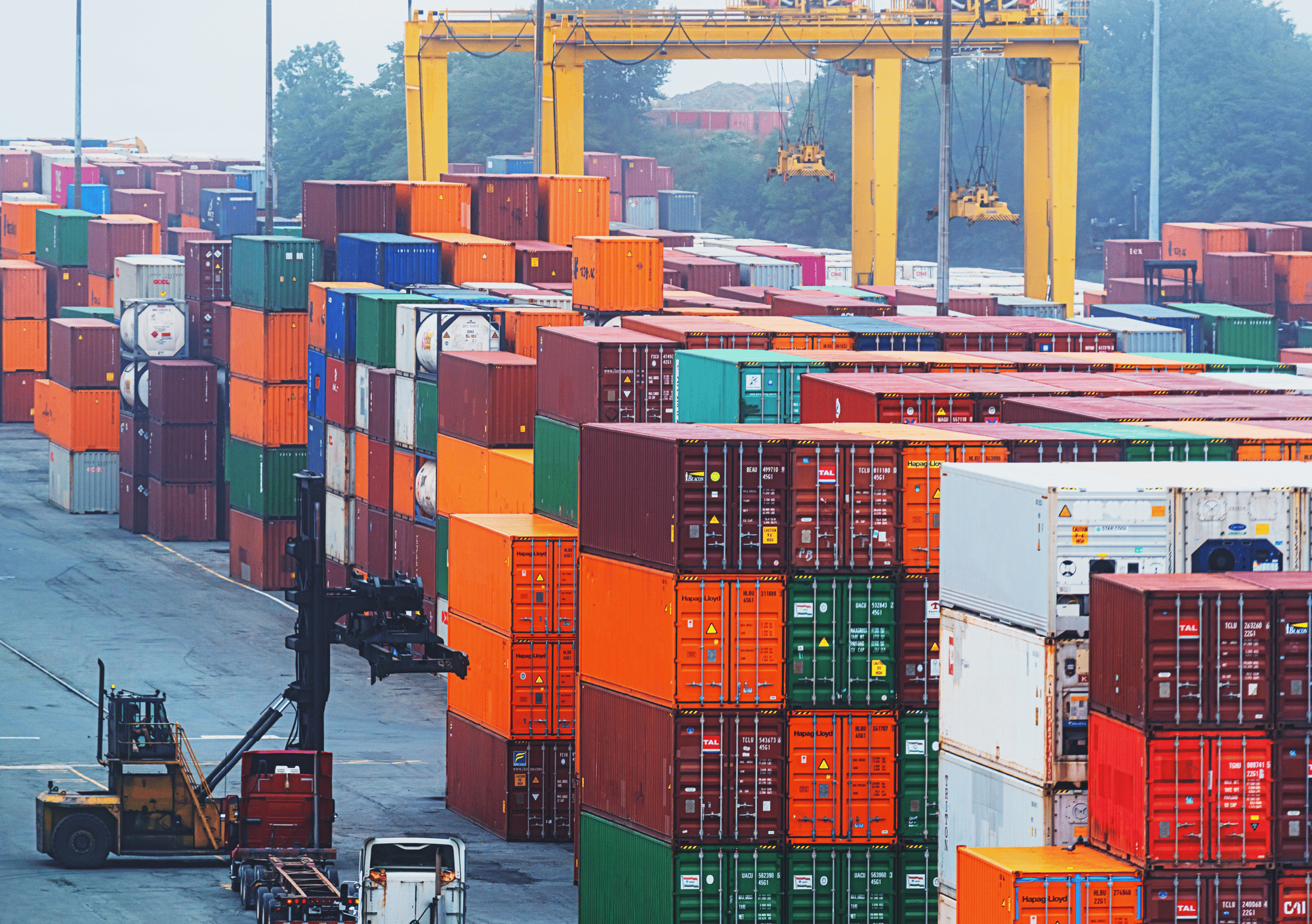

The vessel had operational issues and struck the bridge, instantly causing the structure to collapse. Before any shipping can be resumed at the Baltimore port, crews will need to work diligently to remove debris and clear the channel for ships to resume passage. Ocean carriers are already sending notice that this is a force majeure situation, and any existing voyages to and from Baltimore Port will be terminated. Contingency plans are starting with many carriers using New York and Norfolk ports. Governors of New York and New Jersey offered to take shipments to try and minimize supply chain problems. The vessel, almost as long as the Eiffel Tower, was carrying nearly 4700 shipping containers on board, 56 of which contained hazardous material, and it has been reported that 14 of them were destroyed. Environmentalists reviewed the contents and stated there was no immediate environmental threat. The US Army Corps of Engineers is in the process of moving the largest crane on the Eastern Seaboard to help remove the wreckage of the bridge. The Biden Administration has immediately approved $60 million in federal aid to assist. Maryland Governor Wes Moore warned everyone that this is a long road ahead. Until further notice, the port is closed indefinitely.

The vessel had operational issues and struck the bridge, instantly causing the structure to collapse. Before any shipping can be resumed at the Baltimore port, crews will need to work diligently to remove debris and clear the channel for ships to resume passage. Ocean carriers are already sending notice that this is a force majeure situation, and any existing voyages to and from Baltimore Port will be terminated. Contingency plans are starting with many carriers using New York and Norfolk ports. Governors of New York and New Jersey offered to take shipments to try and minimize supply chain problems. The vessel, almost as long as the Eiffel Tower, was carrying nearly 4700 shipping containers on board, 56 of which contained hazardous material, and it has been reported that 14 of them were destroyed. Environmentalists reviewed the contents and stated there was no immediate environmental threat. The US Army Corps of Engineers is in the process of moving the largest crane on the Eastern Seaboard to help remove the wreckage of the bridge. The Biden Administration has immediately approved $60 million in federal aid to assist. Maryland Governor Wes Moore warned everyone that this is a long road ahead. Until further notice, the port is closed indefinitely.

The Port of Baltimore is one of the largest ports for Ro-Ro vessels that carry automobiles and light trucks. The loss of the bridge, along with the port disruptions, affects over 30,000 vehicles a day. The president of the International Longshoremen's Association, Scott Cowan, said the union is scrambling, as roughly 2400 members are at risk of their jobs drying up until the port can be reopened.

Current estimates state that more than 40 ships, including smaller cargo ships, tugboats, and pleasure crafts, remain inside the Baltimore Port. Marine Traffic showed that another 30 ships destined for Baltimore Port will be rerouted.

IL2000’s international team will continue to support our customers with alternative solutions should they be impacted.

Port News

Maersk has already notified customers with import cargo destined for New York, Newark, and Norfolk to arrange for the pick-up of containers as quickly as possible to help with the overflow.

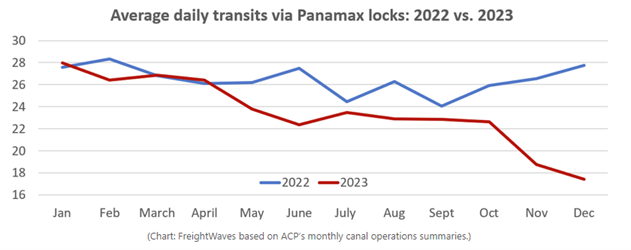

Things are starting to turn a corner for vessels moving through the Panama Canal. Mid-month, the canal began to increase the number of slots per day. As of March 25, slot capacity increased to 27. A spokesperson for the canal stated that efficient water-saving measures have allowed them to increase the daily number of transits while still maintaining the 44-foot draft for the rest of the dry season. While the canal is still not at full slot capacity, which averaged 36 daily pre-drought, the outlook is moving in the right direction. The level of Gatun Lake rose a foot in March.

A ship enters the Miraflores Locks on February 3, 2024. Due to higher water levels in Gatun Lake, the Panama Canal will increase daily booking slots to 27 starting March 25. Source: Supply Chain Dive

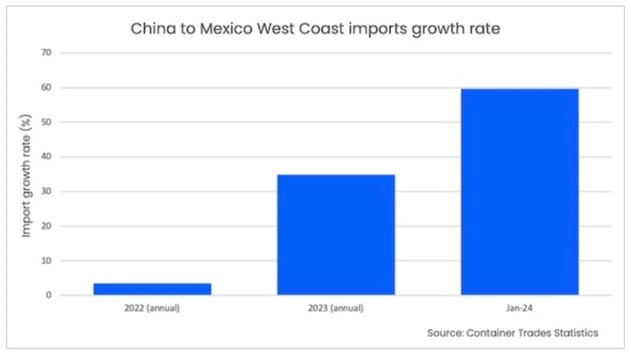

Imports

The US Commerce Department reported that Mexico overtook China as America’s top trade partner for 2023. This is based on the China/Mexico trade lane. Annual growth increased 34.8% in 2023 compared to 3.5% in 2022. This January showed an increase of 60% for container shipping compared to 12 months ago. Chief Analyst from Xeneta, Peter Sand, commented that the data proves businesses in the US are trying to avoid the tariffs placed on goods imported from China to the US. In recent years, Chinese companies expanding into Mexico have seen significant growth.

Source: Splash247

Source: Splash247

Customs

The US CBP released the February monthly operational statistics, which include:

- More than 2.6 million customs entries processed valued at more than $255 billion with estimated duties of nearly $6.5 billion to be collected.

- Ocean accounted for 40.8% of all international trade.

- CBP intensifying its targeting and enforcement efforts to combat textile and trade imports that are not compliant with US law, focusing on de minimis compliance, forced labor enforcement, cargo compliance, regulatory audits and public awareness.

The US CBP has announced that it is partnering with the FDA to expand the focus of the Global Business Identifier (GBI) Test. This will expand the test further and see if it can be used for other supply chain traceability needs. The CBP is also using this to determine if it can address data gaps caused by CBP Manufacturing Identifier requirements.

President Biden signed the Customs Business Fairness Act into law on March 9. This will allow for the full subrogation of claims for the payment of customs duties, protecting customs brokers who are outlying duties on behalf of imports who then file for bankruptcy.

The US CBP issued cybersecurity incident procedures guidelines for brokers, which explain the process and roles and responsibilities of the CBP and the brokerage community regarding how to facilitate the importation, entry, and entry summary process in the event a cybersecurity incident happens to a broker.

The international team is here to help with your logistic needs! Making Logistics Happen! international@il2000.com

Sources: Supply Chain Dive, Splash247, ACL Lines, strtrade.com, cbp.gov, customsandinternationaltradelaw.com, Associated Press, Yahoo, Reuters, Maersk

Published 3/5/2024

INTERNATIONAL MONTHLY MARKET UPDATE

March 2024

IL2000 continues to closely monitor the situation around the Red Sea and the Gulf of Aden. We are close to 80 days without any sustainable resolution. Due to continuing delays, we encourage all customers to plan ahead. Prepare for space availability disruptions, transit time delays, and costs. Many ocean carriers have planned GRIs for later in the month.

The TPM24 conference is taking place March 3 to 6. The theme this year is Extreme Normalization Fallout. The ultimate goal of the conference is to illuminate where the market is heading for the remainder of the year and beyond. We look forward to gathering more insights over the coming month to share with you.

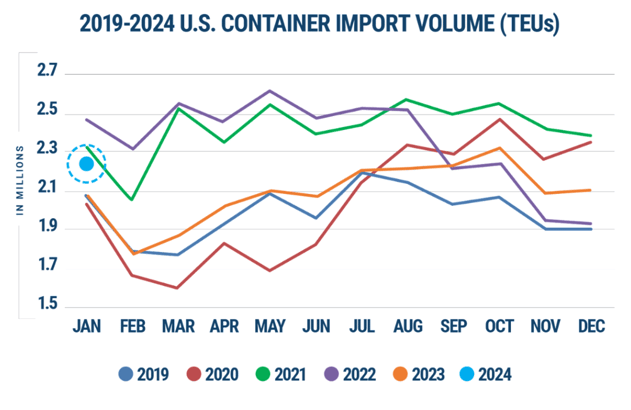

Imports

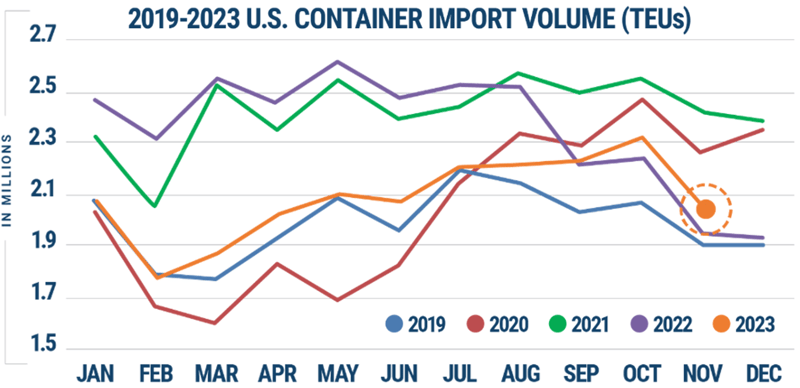

Mid-month data indicates that January saw the sharpest import increase in the past seven years. Despite tensions involving the Suez Canal and the continued drought at the Panama Canal, data from Descartes showed a 7.9% growth. January is usually a slower month as China prepares to go on holiday, and February is when the spike happens. In addition to the rise in volume we’ve been seeing on the West Coast, Norfolk and Baltimore showed a volume rise from 3.4% to 5.1%.

Source: Descartes Datamyne/ FreightWaves

Source: Descartes Datamyne/ FreightWaves

FMC News

February 13, FMC voted four to one to uphold a chassis pool system administrative law judge (ALJ) ruling that went into effect one year ago. The Intermodal Motor Carriers Conference (IMCC) initially started the case against the Ocean Carrier Equipment Management Association (OCEMA). This is a US-based group of 12 major ocean carriers. The law says, “a common carrier, marine terminal operator, or ocean transportation intermediary may not fail to establish, observe, and enforce just and reasonable regulations and practices relating to or connected with receiving, handling, storage or delivering property." OCEMA’s practices deny merchant haulers the opportunity to negotiate rates and terms of service. (Source: FreightWaves)

Labor Talks

At the end of September, the contract between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) is set to expire. The USMX represents 36 coastal ports, including three of the US’s busiest ports: Port of New York and New Jersey, Port of Savannah and Port of Houston. Contract negotiations between the two started back in February 2023, then halted due to issues surrounding wage increases. ILA’s President Harold Daggett cautions there is no chance of extending the contract. As talk of potential disruptions increases, the ILA warns they are prepared for the possibility of a strike in October.

Air Freight

WorldACD released data showing air cargo demand was significantly up compared to last year. The 5% growth can be attributed to various factors, including the Chinese New Year and the ongoing disruptions in the Red Sea. The redirection around the Cape of Good Hope for ocean carriers has increased transit times by up to four weeks in some instances. Airlines have been adding back additional service, resulting in a 12% rise in capacity. While rates have dropped 22% from last year, they remain 32% higher than pre-covid.

WorldACD released data showing air cargo demand was significantly up compared to last year. The 5% growth can be attributed to various factors, including the Chinese New Year and the ongoing disruptions in the Red Sea. The redirection around the Cape of Good Hope for ocean carriers has increased transit times by up to four weeks in some instances. Airlines have been adding back additional service, resulting in a 12% rise in capacity. While rates have dropped 22% from last year, they remain 32% higher than pre-covid.

Customs

CBP’s latest updates released for January 2024 include the following:

- CBP processed over 2.7 million entry summaries valued at more than $267 billion, with estimated duties being nearly $7 billion. Of this, 44% was via ocean entries.

- Eradicating forced labor from our supply chains continues to be a priority of the US government, with CBP leading the efforts. CBP stopped 424 shipments valuing $236 million suspected of use of forced labor.

The US is the world leader in taking action against forced labor. The US CBP is transparent that they will continue to prioritize enforcement of preventing products from forced labor from entering into US commerce. The USCBP is the only US government agency and one of the few agencies in the world with legal authority to take this kind of action.

The Office of Foreign Assets Control sanctioned a procurement network for facilitating the illegal export of goods and technology from over two dozen US companies to end-users in Iran.

The United States Trade Representative and the Interagency Committee for Trade in Automotive Goods conducted a hearing to examine feedback concerning the implementation of the USMCA, explicitly focusing on automotive trade.

The international team is here to help with your logistic needs! Making Logistics Happen! international@il2000.com

Sources: FreightWaves, AirCargo News, WorldACD, TPM24, Maersk, Customs & International Trade Law, and cbp.gov

Published 2/5/2024

INTERNATIONAL MONTHLY MARKET UPDATE

February 2024

Over the last few weeks, mass diversions of container ships are now rerouting around Africa’s Cape of Good Hope. Carriers sent a notice that transits through the Red Sea should stop altogether due to the heightened security risk. Safety for the crews is their number one priority. As carriers adjust their schedules to longer routes, the Chinese New Year’s decreased demand will help keep vessels moving. Below is a snapshot released by Marine Traffic at the end of January showing current container ships routing around Africa.

Source: FreightWaves

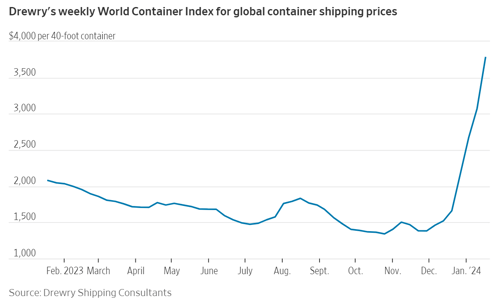

With the continued attacks in the Red Sea, rates over the last month have almost doubled. According to the Drewry, the average cost of a 40ft container rose 23%. The increases are not limited to the disrupted trade routes between China and Europe. Spot market rates from China to Los Angeles rose 38% in just one week in January.

Source: Wall Street Journal

The Federal Maritime Commission (FMC) will hold an informal hearing on February 7, 2024. They will examine how conditions in the Red Sea and Gulf of Adens regions impact commercial shipping and global supply chains.

FMC also announced that Transpacific Eastbound Carriers have recently updated their respective tariffs to implement general rate increases (GRIs) effective February 15 and March 1. The carrier list includes CMA CGM, COSCO, Evergreen, Hapag, HMM, ONE, Yang Ming, and ZIM. The rate increase averages $1000 to $2000 per date for each carrier.

Panama Canal

News posted on the Panama Canal continues to decline. Transits dropped another 4.7% in December, with an overall 21.9% decline since October. Panama has entered its dry season, which has been extended to May this year. Reservations were further restricted by the Panama Canal Authority (ACP). Data shows the locks averaged 17.42 transits daily, down 37% from last year.

Source: FreightWaves

Port News

- Long Beach is seeing berthing delays as vessels bunch up due to late arrivals.

- Wait times in Houston have increased recently to 3 to 5 days, as the port has several cranes under repair.

Rail

One year after the massive derailment in Ohio, Norfolk Southern is the only Class I railroad to join a Federal Railroad Administration safety program. NS President and CEO Alan H. Shaw stated that the company is committed to setting the gold standard for rail safety. The goal is to foster an environment where safety concerns can be reported without workers fearing losing their jobs. It encourages employees to report any "close call" incidents to keep safety at the forefront.

Customs

Some highlights from CBP’s December 2023 monthly update include:

-

- CBP continues to lead in eliminating goods made with forced labor from the supply chain. In December, CBP stopped 450 shipments valued at more than $187 million.

- CBP seized 1291 shipments that contained counterfeit goods valued at more than $86 million.

- Ocean imports were up in December, accounting for 41% of the total import value; CBP processed more than 2.6 million entry summaries valued at more than $260 billion, with estimated duties being nearly $6.3 million.

- CBP is modifying the timing of the automatic release message for non-express air cargo effective January 27 to give CBP sufficient time to review entries and notify the filer of holds.

- FMC has ruled that starting February 1, Common Carriers and Conferences must provide public access to their tariff publication systems free of charge.

The international team is here to help with your logistic needs! Making Logistics Happen! international@il2000.com

Sources: Wall Street Journal, Drewry Shipping Consultants, Distribution Publications, Maersk, Freight Waves, Maersk, CBP.gov, customsandinternationaltradelaw.com

Published 1/4/2024

INTERNATIONAL MONTHLY MARKET UPDATE

January 2024

As we head into the new year, the looming drought and delays at the Panama Canal bring uncertainty for shippers. Now, there is also the threat to vessels traveling through the Suez Canal, which has had carriers scrambling for solutions for the last 20-plus days.

Just over the holiday weekend, another Maersk vessel was attacked. The Maersk Hangzhou had a double attack as the US sent two destroyers in to assist. Maersk then issued a statement to pause all transits through the Red Sea / Gulf of Aden until further notice. Carriers have started rerouting vessels around Africa, causing delays, war risk surcharges, and vessels being held in position while they figure out their next move.

Carriers are now using the uncertainty in the Red Sea to raise freight rates. The Federal Maritime Commission has been permitting carriers to publish new tariffs with less than the usual 30-day notice. Maersk and MSC have already issued letters. CMA announced new Peak Season Surcharges that continue to increase. The Shanghai Containerized Freight Index (SCFI) showed a 162% rate increase from Shanghai to North Europe over the last two weeks.

Shippers enter 2024 uncertain of how long the Suez Canal situation will continue. This, along with the Chinese New Year almost upon us, will continue causing freight rates to increase. Capacity will be limited, blank sailings will increase, and we will see delays in the overall global transit. We suggest that all our customers review their lead times and check with the international team for the best options.

Europe

Starting January 1, 2024, the Europe Emissions Trading System (ETS) surcharge will be applied to all cargo originating from or arriving at an EU-operated port. Europe’s goal is to become the first climate-neutral continent by the end of 2050. The ETS intends to assist Europe by introducing a price for all greenhouse gases being emitted in this sector.

China

The Lunar New Year celebration is a little later this year, starting February 10 and lasting through the 17th. If something is urgent, please check with your supplier to ensure the product can be shipped prior to their closing. Many carriers implement blank sailings during this time, and pre-booking is suggested.

South China Customs offices (excluding Hong Kong, Da Chan Bay, Yantian, and Shekou) announced they will be off duty during the Chinese Lunar New Year period. Barge services will be suspended during this time as customs will be closed. Any cargo arriving during this time will be delayed for connection and incur demurrage. The planned barge suspension will be from February 5 through the 18th.

Port News

US Imports are still tracking higher than before the pandemic. However, November shows a 9% fall, with the East Coast and Gulf Ports getting hit the hardest. Conditions worsening at the Panama Canal combined with seasonality are causing the decline.

Chart: Descartes. Data: Descartes Datamyne. Source: FreightWaves

Customs

On January 2, the US Census Bureau sent out a notification with updated Schedule B and Harmonized Tariff Schedules codes that will not be valid in 2024. They will give a 30-day grace period for the outdated codes. Please see the links below for more information:

- The 2024 Schedule B and HTS tables are available for download at: http://www.census.gov/foreign-trade/aes/documentlibrary/#concordance

- The current list of HTS codes that are not valid for AES is available at: https://www.census.gov/foreign-trade/aes/documentlibrary/concordance/hts-not-for-aes.txt

On December 24, the US Departments of Commerce, Treasury, Justice, State and Homeland Security Issued a Joint Quint-Seal Compliance Note; "Know Your Cargo: Reinforcing Best Practices to Ensure the Safe and Compliant Transport of Good in Maritime and Other Forms of Transportation." This document highlighted the responsibility of individuals' and entities' participation in global trade to assess their risk and implement compliance programs. This note included potential indicators that could be an effort to evade sanction and export controls and recommended compliance practices that should be followed.

The Customs Broker Triennial Status Report opened on December 18, 2023, and is due by February 29, 2024.

CBP's November 2023 monthly update was published on December 22, 2023. Some of the highlights include:

- Over 2.7 million entry summaries were processed and valued at more than $268 billion, with an estimated duties of $6 billion to be collected. Ocean entries accounted for 38%.

- CBP seized 1607 shipments containing counterfeit goods valued at more than $118 million.

- The defense of the US agricultural system is huge, and CBP issued 363 emergency action notifications restricting and prohibiting plant and animal products from entering the US.

The last meeting of 2023 for the Commercial Customs Operations Advisory Committee was held on December 20, 2023. It unanimously passed 12 recommendations on export modernization, rapid response, and North American trade. These recommendations aim to improve US CBP’s operation and communication while empowering businesses to remain compliant with trade laws and policies.

The international team is here to help with your logistic needs! Making Logistics Happen! international@il2000.com

Sources: HMM, Maersk, FreightWaves, American Shipper, CBP.gov, Customsandinternationaltradelaw.com, The Telegraph UK, MSC, CMA, US Census